Things you should know about IFSC code

Have you recently moved to India? Or are you sending money from abroad? For both cases, you will need bank IFSC code for money transactions. Many people still don’t know what an IFSC code is. You will want to know what an IFSC code is and how to use it, before sending money to anyone online.

Though India has a unique system for electronic fund transfer, every customer should spend some time and know what is necessary to ensure that money is transferred to the right place when sending it to a bank account.

IFSC code

An IFSC code includes 11-digit numbers and you will find it on bank checks and other bank materials. This code is used to find individual bank branches that perform different online money transfer options. In simple words, an IFSC code is like a postal code that tells the exact location. IFSC code HDFC bank Mumbai or any other banks allows customers to do electronic fund transfer and ensures that money is received on the right account.

Meaning of IFSC

IFSC – Indian Financial System Code was initially assigned by the RBI (Reserve bank of India) to recognize unique branches using national electronic fund transfer system. Today, IFSC codes are used by electronic payment system applications such as RTGS – Real Time Gross Settlement. And, now any transfer system that is being regulated by the RBI needs the right IFSC code of branch, for example HDFC IFSC code Bangalore. You need the IFSC code for a branch where the recipient account is based to make an electronic fund transfer to a bank in India, such as HDFC IFSC Code Chennai.

Number of digits

IFSC code includes 11-digit characters and the first 4 are alphabetic characters that represent the bank, number zero is reserved for future use and the last 6 digits are code numbers representing the individual branch of the bank.

How to find IFSC codes?

Finding IFSC codes of particular branches of banks is not an easy job. One simple mistake can put you at great risk of sending your money to a non-intended branch and account. So, be careful in choosing the right IFSC code. For example, you want to send money to Axis bank Delhi. You have to find Axis Bank IFSC Code Delhi while sending money to that particular branch account. You should consult with your bank and get the right code for the recipient.

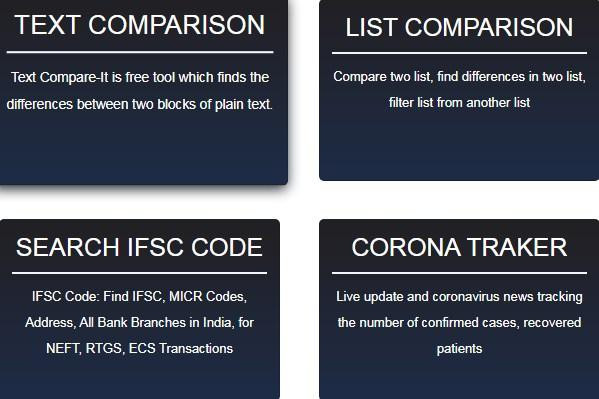

Without the right code, money transfer could end in the wrong place, or you may fail to go through. This is where IFSC code checker tools come at your rescue. These are tools helping you to find the right IFSC code of any bank and branch in India. Imagine you have to send money to Axis bank Mumbai and you don’t know the IFSC code of the specific branch in the area. With the IFSC code checker tool, you can easily find Axis Bank IFSC Code Mumbai and send money quickly. So, make use of these tools and enjoy great peace of mind knowing that you have send money to the right account.

Comments

Post a Comment